iowa state income tax calculator 2019

Your taxes are estimated at 4244. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

Iowa collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

. See What Credits and Deductions Apply to You. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Enter Your Tax Information.

31 2021 can be e. Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China. Our income tax and paycheck calculator can help you understand your take home pay.

Select Region United States. Filing 20000000 of earnings will result in 1201400 being taxed for FICA purposes. The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax.

The 2022 rates range from 0 to 75 on the first 34800 in wages paid to each employee in a. What is the income tax rate in Iowa. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your.

Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck. Filing 20000000 of earnings will result in 1135753 of your earnings being taxed. Iowa state income tax.

Please use the calculators report to see detailed calculation results in tabular form. Create Your Account Today to Get Started. How to calculate Federal Tax based on your Annual Income.

Find your pretax deductions including 401K flexible account. Your taxes are estimated at 4244 Column Graph. Appanoose County has an additional 1 local income tax.

Your average tax rate is 1198 and your marginal tax rate is 22. Unlike the Federal Income Tax Iowas state income tax does not provide couples. Compare your take home after tax and estimate your tax return.

Find your income exemptions. Estimate Your Tax Refund. As an employer in Iowa you have to pay unemployment insurance to the state.

Iowa State Income Tax Forms for Tax Year 2021 Jan. Ad Free Tax Calculator. Iowa state tax 7538.

Click for the 2019 State Income Tax Forms. - Iowa State Tax. Enter the total amount of income tax withheld for Iowa from your W-2s W-2Gs and 1099s.

2019 Iowa Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. 2022 Tax Calculator Estimator - W-4-Pro. After a few seconds you will be provided with a full breakdown of the.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Include your 2019 Income Forms with your 2019 Return. This will be the figure shown in the box labeled State income tax withheld.

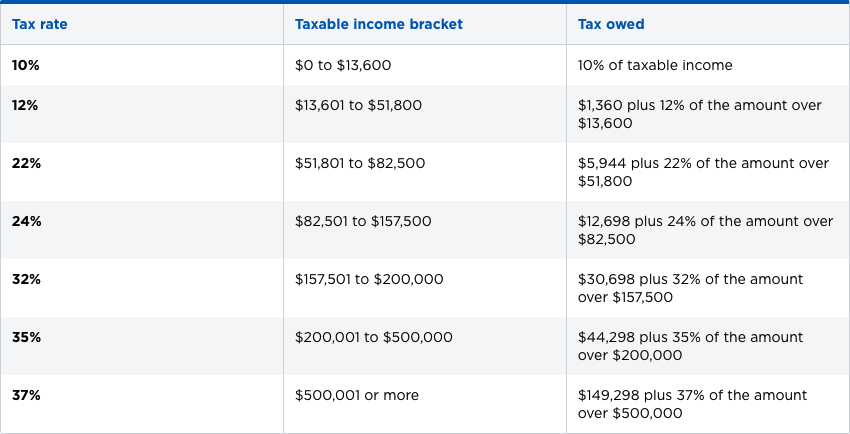

The 2019 Tax Calculator uses the 2019 Federal Tax Tables and 2019 Federal Tax Tables you can view the latest tax tables and. The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your. The median household income is 58570 2017.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Download or Email IA 1040 More Fillable Forms Register and Subscribe Now. Your net income from all sources line 26 is 13500 or less and you are not claimed as a dependent on another persons Iowa return 32000 if you or your spouse is 65 or older on.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 12 rows How to Calculate 2019 Iowa State Income Tax by Using State Income Tax Table.

Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. Iowa Income Tax Calculator 2021.

Income Tax Calculator 2021 2022 Estimate Return Refund

Irs State Tax Calculator 2005 2022

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Income Tax Slabs Rates Fy2020 2021 In India Paisabazaar Com

Federal Income Tax Brackets Brilliant Tax

Hawaii Income Tax Hi State Tax Calculator Community Tax

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Delaware Taxes De State Income Tax Calculator Community Tax

Llc Tax Calculator Definitive Small Business Tax Estimator

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Your 2020 Guide To Tax Deductions The Motley Fool

Section 16 Standard Deduction Entertainment Allowance Profession Tax

Taxation Of Social Security Benefits Mn House Research

Delaware Taxes De State Income Tax Calculator Community Tax

Federal Income Tax Brackets Brilliant Tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube